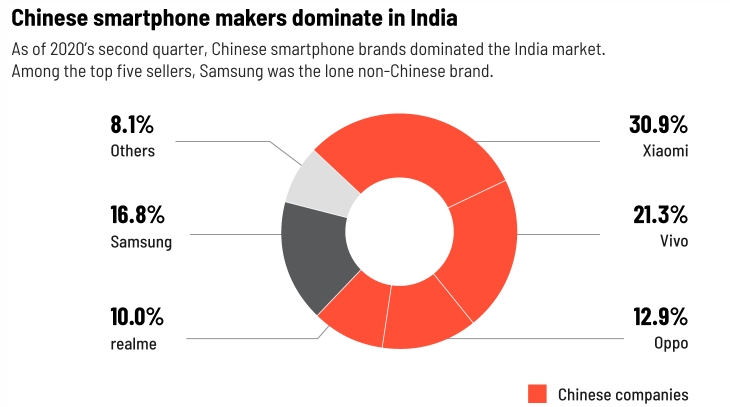

While few details are known about the new phone, the deal suggests that Google and Jio could shake up a market where Chinese brands accounted for more than 75% of total sales in the quarter ended in June, according to research firm Canalys. South Korea’s Samsung was the No. 3 seller with just under 17%.

“Depending on the product proposition that comes from this Jio-Google partnership, it could potentially pose a challenge,” she added.

An untapped market

Much has been made of India’s growing mobile internet market. Roughly 450 million Indians already have smartphones, according to Counterpoint Research. They rely on them to stream content, shop, hail rides and order food. But about 500 million people don’t yet own such devices — and Google and Jio want to give them a cheap way in.

“They should not be deprived of the benefits of the digital and data revolution,” said Mukesh Ambani, the CEO of Jio parent company Reliance Industries and the richest man in Asia, during a company event last week. He said that the goal of the partnership with Google is to design smartphones for a “fraction” of what they currently cost.

“Jio is a company that’s very focused on the rural side, because that’s the real India,” said Tarun Pathak, associate director at Counterpoint Research. “You have a big funnel [of] users who are yet to come on board and experience and taste this internet for the first time.”

Most of those people are using feature phones — old-school mobile devices with numeric key pads and basic screens — on India’s 2G network. Getting them on 4G or 5G smartphones would be a “win-win” for both companies, Pathak said, because Jio can provide new users with data plans, while Google serves them YouTube, search, maps and other apps.

Jio already sells cheap 4G feature phones with basic data plans that can access the internet and run stripped down versions of a few apps. But fewer than 20% of India’s feature phone users are on Jio devices, according to Pathak.

To reach India’s huge low-tier market, Counterpoint Research and IDC analysts say the two companies would have to develop a smartphone with an Android-based operating system for less than $50.

That could be difficult to achieve.

Kaur noted that costly parts such as memory, chips and display panels typically inflate the price, pushing smartphones above the $50 range. And even a $50 price point is more than most rural Indians can afford, she added.

But if Jio and Google can pull it off — and get those users to stick with them for upgrades — that could be a big loss for Chinese smartphone makers. Indian foreign policy think tank Gateway House expects the country’s smartphone users to double to 900 million by 2025, as income levels rise and smartphones get cheaper.

The upside for Google and Jio

Selling ultra cheap smartphones likely won’t make Jio a lot of money. The company will be making razor thin margins on the hardware, or more likely will have to subsidize the cost of the devices by bundling them with other phone and data services. But a successful breakthrough would get millions more Indians onto ecosystems owned and controlled by Jio and Google.

Jio already offers a family of apps to watch movies, stream music and shop online. And for Google, “it’s less about money, it’s more about profiling users,” said Pathak.

India is also “a dream for any tech company given the diversity,” said Blaise Fernandes, director at Gateway House.

The potentially huge, diverse datasets Google could harvest from new and existing Indian smartphone users would help it “get better reach, and in return better ad sales and subscription revenues” in India, and “better app efficiencies in other markets,” he said.

Android already has a lock on the Indian market, accounting for 91% of the mobile operating systems in use there in 2019, according to Statista.

Winning ‘brownie points’ with India

Market opportunities aside, Jio has also emerged as a homegrown tech champion at an opportune time: Nationalist sentiment in India is on the rise.

Canalys reported last week that smartphone sales in India plummeted 50% last quarter, compared to the same period a year earlier. While that drop was largely driven by store shutdowns and the economic battering caused by the coronavirus pandemic, the market research firm pointed out that Chinese smartphone makers have been dealing with more than just fallout from Covid-19.

“There has been public anger directed towards China,” Canalys research analyst Adwait Mardikar wrote in a note. “The combinations of this and the […] self-sufficient initiatives by the government have pushed Chinese smartphone vendors into the eye of the public storm.”

Even before the country’s recent dispute with China, Prime Minister Modi and his ruling political party “have been pushing ‘India first’ ideas around tech for several years,” said Abishur Prakash, a geopolitical futurist and co-founder of Center for Innovating the Future, a consulting firm that works on technology and geopolitics.

“Companies like Jio, who are championing homegrown alternatives, are accelerating India’s nationalistic moves,” he added.

Such moves earn Jio “brownie points from the government,” according to Pathak, of Counterpoint Research, who added that a good chunk of Google’s investment in Jio will likely be used to buy stakes in a lot of Indian startups.