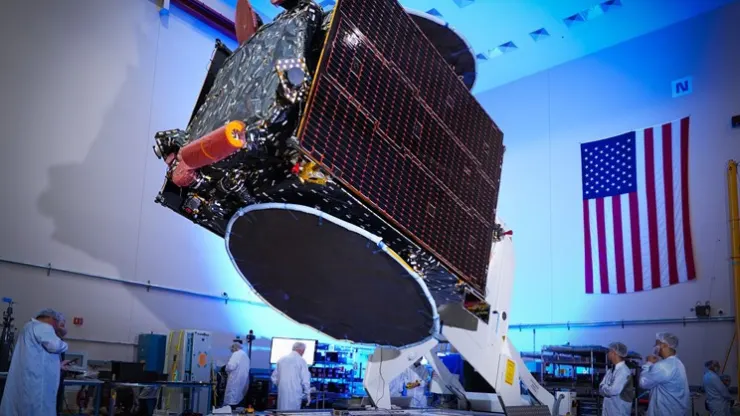

On Friday, the space imagery and infrastructure company Maxar made public their deal to be acquired by a private equity firm led by Advent International and take themselves private.

Due to the cash-only nature of the transaction, Maxar now has an enterprise value of about $6.4 billion. The private equity firm Advent will be purchasing a share in Maxar worth $3.1 billion, and the British Columbia Investment Management Corporation will also be making an equity investment of $1 billion.

Dan Jablonsky, CEO of Maxar, was quoted by CNBC as saying, “We’re pretty thrilled about it.” He explained that this would “enable us to invest even more quickly in the business, speed things like Legion seven and eight [satellites], and other technologies we have been developing.”

As of market closure on Thursday, shares of Maxar were trading at $23.10 each; hence, the deal with Advent to purchase shares at $53 each marks a price that is over 130% more than what the stock has been trading at recently.

Register your email address on this page to start receiving CNBC’s Investing in Space newsletter on a weekly basis.

Since he was appointed CEO of Maxar in January 2019, Jablonsky has spearheaded a multi-year turnaround effort at the company, and as of right now, the stock is trading near $5 per share. The price of the agreement with Advent is quite close to the all-time high that Maxar share prices reached at the beginning of 2021, before falling in line with other space companies this year.

According to what Jablonsky had to say, “We took a really thorough and thoughtful look at all of the elements.” It turned out that this was the perfect business deal to make at the perfect time.

The deal between Maxar and Advent includes a “go-shop period” of sixty days, which will come to an end on February 14 and provide the company the opportunity to evaluate alternative propositions.

As a result of this, Jablonsky remarked that it is “still very early days” to speculate on what the future of Maxar will look like under Advent’s leadership. He declined to comment on whether the new owners may attempt to carve apart Maxar’s operations, which include satellite images and manufacturing – or whether he will stay on. He also declined to comment on whether or not he will continue on.

“Love what we’ve created and what we’re doing here and probably can’t say much more than that right now,” Jablonsky said. “Love what we’ve built and what we’re doing here.”